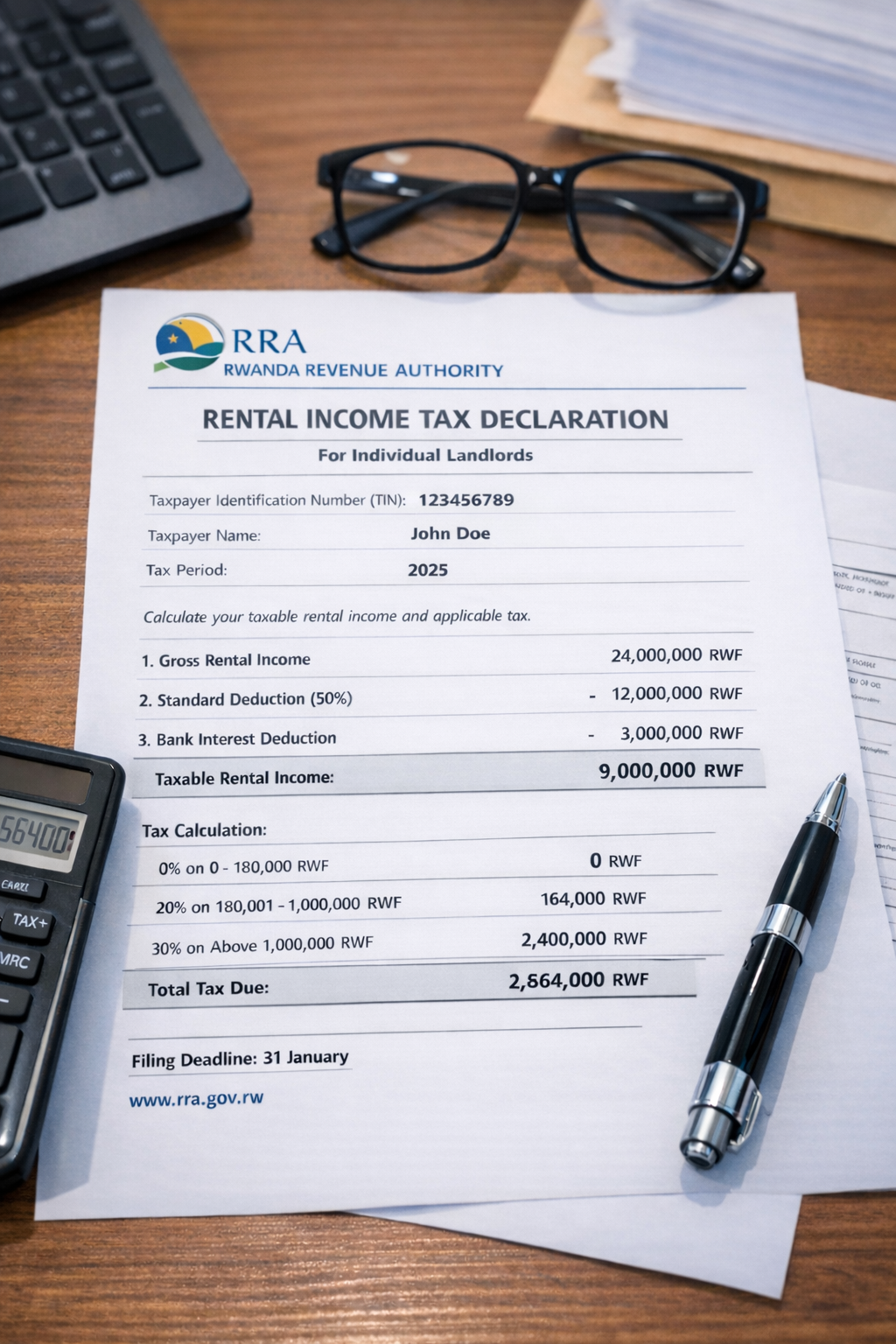

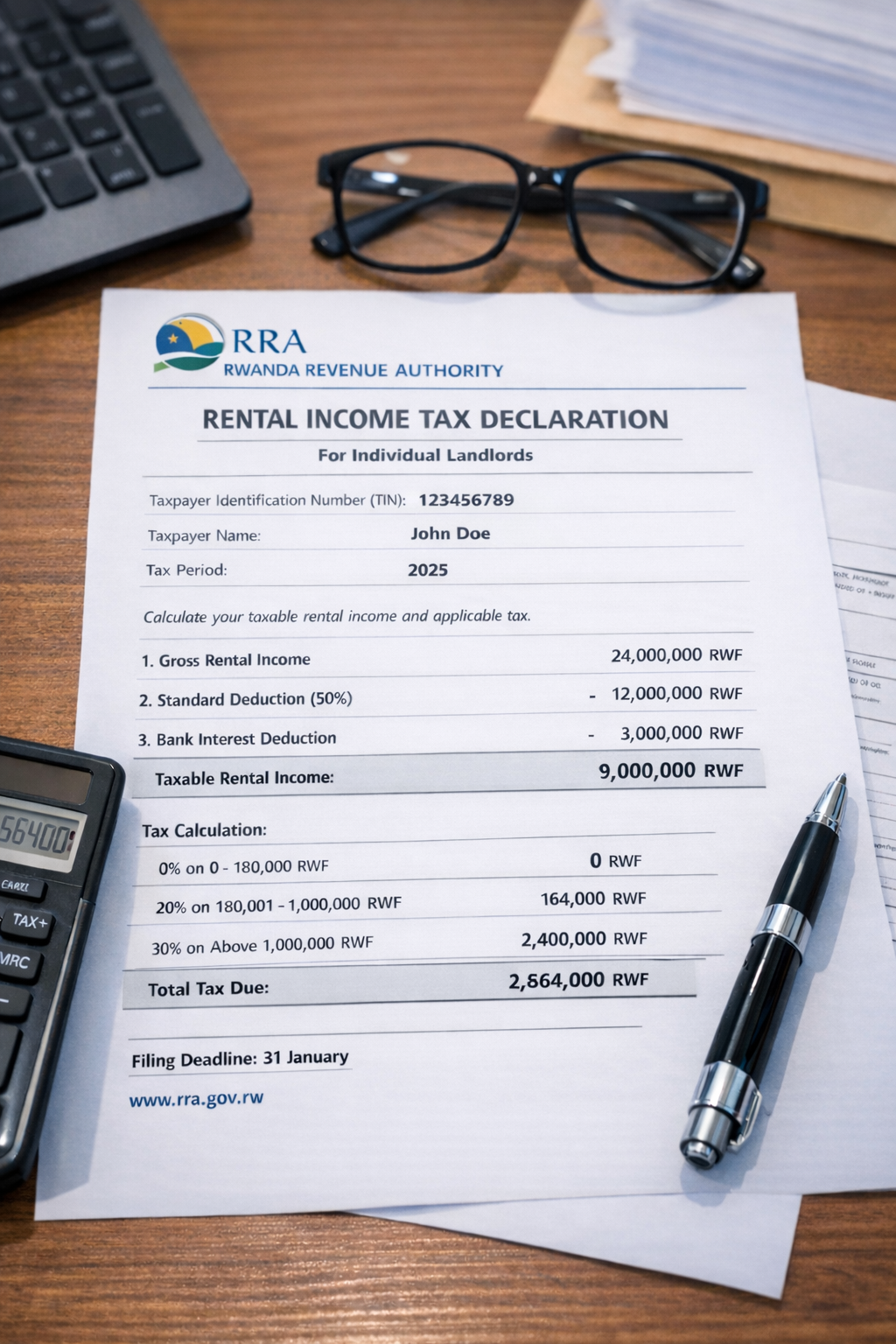

Declaring Rental Income in Rwanda: A Step-by-Step Guide for Property Owners

A Practical Guide for Individual Property Owners If you rent out property in Rwanda as an individual (or as another non-corporate taxpayer not under Corporate

Staff meal expenses are common in many organisations across Rwanda, especially those operating in shifts, remote sites, or high-intensity environments. However, many companies treat these costs as non-deductible by default, missing an opportunity to optimise their Corporate Income Tax (CIT) position while remaining compliant.

This article explains how staff meal expenses are typically treated, when they may qualify as deductible, and how businesses can structure them correctly.

The Default Rule

In most cases, staff meals are treated as employee welfare benefits and are therefore considered non-deductible for Corporate Income Tax purposes if no specific structure is in place. As a result, many organisations simply record these expenses as general operating overhead without exploring their tax treatment.

The Exception Many Companies Miss

There are situations where staff meal expenses may be accepted as deductible by the Rwanda Revenue Authority (RRA). This typically requires special consideration and clear justification that the meals are:

When these conditions are met, deductibility may be unlocked as part of a compliant tax position.

When Staff Meals May Qualify

Eligibility generally applies where meals are directly linked to operational realities, such as:

In such cases, providing meals is not a perk but a practical requirement for business continuity.

What the Rwanda Revenue Authority Typically Looks For

For staff meal expenses to be considered deductible, companies should be able to demonstrate:

Good documentation and consistent implementation are essential.

What This Means for Your Business

When approved, staff meal expenses can reduce taxable profit and improve cost efficiency while remaining fully compliant with tax regulations. This makes them a sustainable and strategic tax optimisation tool rather than simply an administrative cost.

Organisations that structure these expenses properly benefit from:

Key Takeaway

Staff meals are not just a routine employee benefit. When handled correctly, they can become a legitimate and strategic Corporate Income Tax deduction.

The difference lies in how the expense is structured, documented, and justified from a business perspective.

Need Support?

Unsure whether your staff meal costs are tax-deductible?

Visions Africa supports organisations in reviewing the tax treatment of staff benefits, structuring compliant solutions, and securing RRA approval where required.

For tailored guidance, contact our team at contact@visionsafica.com to learn more.

For a deeper dive into this topic, including practical examples and documentation considerations, download our full guide: A Corporate Income Tax Guide (PDF)

A Practical Guide for Individual Property Owners If you rent out property in Rwanda as an individual (or as another non-corporate taxpayer not under Corporate

For many entrepreneurs in Rwanda, navigating compliance requirements can feel overwhelming—especially in the early stages of building a business. One of the most common areas